As we commented on last January, on the verge of commercializing all-electric vehicles to compete against Nissan’s Leaf and Chevrolet’s Volt, Renault revealed after a five-month internal investigation it had suspended three senior executives, with a decision on permanent sanctions to follow. As it was to be expected, there were no direct official statements from the companies and executives involved…until now.

Nonexistent Accounts

One of the key “smoking guns” alleged in the original investigation, bank accounts alleged to have be controlled by the fired executives, did not exist as alleged in secrecy heavens Switzerland and Liechtenstein. Renault’s CEO and COO have apologized to the executives and, according to some reports, pledged to repair the injustice. The executives, on the other hand, have taken legal steps against their accusers.

Trade Secrets

Trade secret misappropriation in a technologically dynamic sector is a chronic problem which organizations must confront with sound policies and procedures.

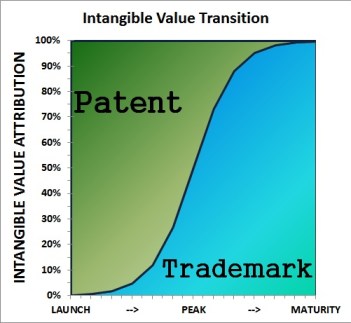

Properly safeguarded, trade secrets can give an organization a substantial competitive edge. Once disclosed, however, they cannot be retrieved and their commercial value vanishes, although civil litigation may stop further dissemination and recover economic damages.

As an intellectual property consulting firm, IPmetrics has been instrumental in the appraisal and enforcement of for this type of property, as well as the rest of the spectrum, from Patents and Copyrights, to Trademarks and Rights of Publicity.

You must be logged in to post a comment.