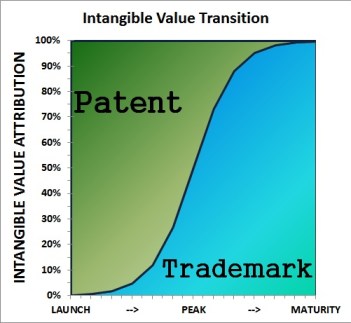

In several cases, we have argued, modeled, and quantified the value transfer process that occurs during a product’s life cycle from patents to trademarks. When the product in question is differentiated in the marketplace because of patented features, at the outset it is logical to attribute a substantial portion of intangible value to the patent portfolio (or a properly defined portfolio of technology intangibles if trade secrets are key) and, if appropriate the umbrella brand of a parent trademark (or, again, a portfolio of marketing intangibles).

As the product life cycle advances, customer loyalty, brand equity, and other marketing attributes become increasingly associated with the trademark and, over time, the relative monopoly initially afforded by patent protection yields its place to what we economists call “monopolistic competition” as technological changes and the spectrum of substitutes for the product’s utility advance and introduce competing, but relatively unique, new products. Eventually, patent protection expires and there comes a point in the life cycle (independent of the maturity of the market) upon which the only intangible value resides in the trademark.

This process is characteristic in the pharmaceutical industry, where a new drug would be introduced under patent protection with additional technology assets being covered by “data exclusivity” by the regulatory authorities. As the product gains acceptance, prescribers associate its properties to the trademark and patent protection is lost (even during the statutory patent term) due to the regulated provisions allowing for the accelerated introduction of generic medications. Continued net profits from the sale of the original and, possibly, ancillary sales from derivative products (including “extended release” variants) are directly attributable to the marketing assets, namely accruing to the trademark, as the technology becomes widely available for competitors to use.

© IPmetrics LLC 2011

The graph illustrates this general principle as the gradual shift from 100% value from the patent side, to a 100% to the trademark side.

Recently, we identified validation of the Patent to Trademark Value Transition in the food industry, recognized by the IP creator for an iconic global company: Nestle SA. As reported by Bloomberg, “Eric Favre, who created the first version of Nespresso in 1976 and has since left Nestle to set up a competitor, will maintain its leadership as the biggest maker of coffee capsules because of the strength of the Nespresso® brand even as patents on the product expire.” Nespresso sales probably almost tripled to 3 billion Swiss francs ($3.2 billion) in 2010 from 1.2 billion francs in 2006, according to Jon Cox, an analyst at Kepler Capital Markets in Zurich.

In an interview at the headquarters of Monodor, his coffee-supply company, Favre said “A plethora of rival capsules will come out,” [but] “The Nespresso brand is more important than the patents.”

You must be logged in to post a comment.