By: Fernando Torres, MSc

Trademarks, patents, and other intellectual property (“IP”) are generally recognized as business assets, and many characteristics of a trademark are paralleled by other asset classes like financial assets, in particular promises-claims. Yet, trademark values cannot be observed directly; they cannot be looked up in the Wall Street Journal like stocks and bonds. IP values in general, and trademark values, in particular, require a specialized appraisal.

Traditionally, the trademark values have been under-reported in financial statements due mainly to two factors, which stem from generally accepted accounting principles (GAAP):

- Internally-generated intangible assets are not capitalized nor reported on the balance sheet; rather, their historical costs (to design, prosecute, maintain, advertise, and defend) are expensed in the current year, and

- A vague Goodwill category has been utilized to capture the all-encompassing excess of the purchase price over book value paid in mergers and acquisitions.

Since 2001, the Financial Accounting Standards Board (FASB) issued statements 141 and 142 reforming that practice, at least partially. The changes introduced with those statements have created a uniform framework whereby the acquiring entity must perform a detailed purchase price allocation that segregates the values attributable to trademarks and other IP. More specifically intangibles based on contracts and legal rights are distinguished from general Goodwill, which remains a residual value. This accounting definition, however, is not without controversy. Analytically, Goodwill is derived from the existence, quality and character of other intangible assets and intellectual property, and it is not a truly separate and identifiable asset. Reputation for quality or service, customer loyalty, and other attributes of Goodwill exist to the extent they are supported by identifiable and valuable intangible assets, not in a vacuum.

Consequently, full trademark values are not reflected in company financials, and when they are reported, they only refer to acquired trademarks. This situation distorts simple measures of intangible value applied to publicly traded companies, such as those listed on the S&P500 index.

Pursuant to the latest regulations, publicly-traded companies generally disclose the itemized values of acquired intangibles in their Securities and Exchange Commission (SEC) filings and, therefore, have been building up a potential database of trademark values in particular. In addition, a certain proportion of each year’s mergers and acquisitions (M&A) represent acquisitions of assets in the context of bankruptcy proceedings, i.e. a liquidation of assets. When this occurs, additional research usually can determine the necessary pre-liquidation sales levels to complete the trademark value analysis.

Over the years, IPmetrics has been building a database of relevant transactions for the specific purpose of supporting the econometrics valuation of intangibles in liquidation and restructuring. The database is in continuous development, and the use of any non-public information is gradually being allowed under the terms of confidentiality agreements or as soon as it becomes part of the public record. In this post, we introduce the bases of the empirical analysis of trademarks, in liquidation and in the general course of business.

The Trademark Value Model

The value of trademarks purchased in the course of business transactions is a function of many factors. Typically, the revenue associated with such intellectual property, as well as the relevant discount rate, useful life assumptions, applicable royalty rate, profit margins, risks, and market conditions determine trademark values. Rather than looking to explain stock prices or marginal profitability as a function of intangibles, we seek to determine, or explain, the value of a firm’s acquired trademarks as a function of the sales levels they support, the context in which it was acquired (liquidation or going concern), the industry, and other exogenous factors.

From our experience in intellectual asset consulting, we have reason to hypothesize that royalty rates, risk, and margins across industries play a less determinant role than sales, and tend to mutually compensate their effect on the ratio of trademark value to sales. The conceptual model presented below, and the initial empirical results which we report here, seem to support this conjecture.

An Equilibrium Model

The most abstract expression of the conceptual model of trademark value is the following functional relationship between trademark value (V™) and its explanatory variables:

V™ = f(S, t, GL, LIQ, other factors)

The general model in this equation simply states that V™ is a function of the amount of revenue associated with the trademarks (S), the year in which the transaction takes place (t), whether the trademarks refer to a global market or are mainly domestic (GL), whether the trademarks were purchased in a liquidation scenario (LIQ), and other factors that will be modeled as an error term in the empirical version of the model.

The monetary value of a trademark, as typically incorporated in the purchase price allocations we researched, is calculated on the basis of the “Relief from Royalty” method. This method can be viewed as a variation of the valuation of an asset as the net present value of the expected income stream accruing to the asset. It can also be considered as an intangible asset parallel to the Discounted Dividend models used in financial analysis. This method typically uses royalty rates that are based on comparable marketplace transactions, and applies them to a forecast of the revenue stream expected to be associated with the use of the asset in the market. In the case of patents, the time horizon is typically no more than 20 years, which is the statutory life of a patent. In the case of trademark assets, on the other hand, the time horizon may extend, for all practical purposes, to infinity, as properly maintained trademark registrations do not lapse.

The functional form adopted in our analysis for the expression in (1), assuming for the purposes of the initial discussion the case of a domestic trademark in a going concern equilibrium, is based on a simple continuous time model of sales growth.

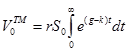

The sales associated with the trademark (St), as a continuous function of time (t) grow at a constant annual rate (g) from time 0. The amount of (nominal) sales is discounted (S’) to the present (t = 0) from any year t using the firm’s cost of capital (k). Each year, royalties are payable to the trademark asset licensor at a market rate (r) which reflects in part the opportunity cost of developing a functionally equivalent trademark, and the operating margins prevailing in the industry where the licensee firm operates. Taking the integral of the infinite series of royalty payments, we can define the net present value of the trademark (V™) in the base year as the area under the growth path of the discounted royalties:

Equation (2) can be solved to yield the a ratio of trademark value to sales as a function of the royalty, discount, and growth rates:

Clearly, equation (3) implies a trademark will be more valuable, absolutely and relative to the annual sales level, the higher the royalty rate it warrants in the market, the faster the growth of the underlying product branded by the trademark, and the lower the cost of capital to the firm.

The following table illustrates the relative orders of magnitude of this ratio, considering a fixed 5% royalty rate, in four scenarios combining high and low risk (reflected in the cost of capital) and growth rates:

|

Trademark Value |

Slow Growth (g=2%) |

Fast Growth (g=5%) |

|

High Risk (k=30%) |

17% |

20% |

|

Low Risk (k=12%) |

50% |

71% |

The only significance of the 5% royalty rate is that it is the most frequent rate among publicly available IP licensing agreements. But, for any given rate, the table seems consistent with the rationale that a trademark is more valuable if, given the risk level of the industry, it is associated with faster growing sales. Trademarks are expected to be more valuable in faster growing / lower risk industries, than in slower growing / higher risk ones.

Considering the conceptual model at this level of abstract of abstraction, we considered the question of what would be the effect of the sale of the trademark asset in an orderly liquidation, carried out in the course of a corporate restructuring process. The royalty rate would generally not be affected, as it is taken to be the prevailing rate in the market for that IP in the specific use it is being exploited. The discount rate, post-reorganization, would also be substantially similar to the pre-reorganization cost of capital, as that is customarily the discount rate utilized, typically the CAPM rate adjusted for size effects and the added risk of the intangible asset class. Finally, the medium-to-long term expected growth rate of the reorganized business of the firm may also not change materially after the reorganization. However, in the market, the trademark’s goodwill and market potential usually suffers by being associated to a bankruptcy, given the essential economic function of trademarks – that of reducing consumer search costs (Landes and Posner, 1987) – as consumers tend to revise their perceptions of quality, stability and other desirable attributes of the branded products. Thus, an initial conjecture was that the effect of liquidation on trademark values is a one-time shock to the value, relatively independent of the specific subject property.

[…] Fernando Torres, MSc, one of our favorite IP value analysts, proposes an intriguing econometric model of trademark values in the IPmetrics blog. Underreported in financial statements, internally developed trademarks have gone begging for a sound and consistent valuation solution, and IPmetrics has built a database of relevant transactions that allows them to perform empirical studies that form the basis of the proposed model. […]

[…] « An Econometric Model of Trademark Values […]